japan corporate tax rate 2020

For corporations other than foreign corporations with share capital or contributed capital exceeding 100 million yen from the fiscal year beginning on or after April 1 2020 it became mandatory for corporations to submit final returns and interim returns for corporation tax local corporation tax consumption tax corporate inhabitants tax. One major proposed change to the domestic corporate tax rules is elimination of the current.

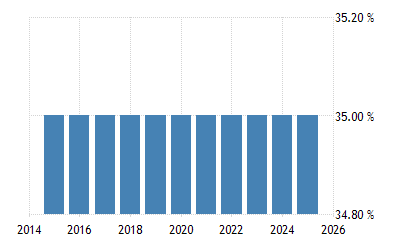

Malta Corporate Tax Rate 2021 Data 2022 Forecast 1995 2020 Historical Chart

The Cabinet approved the Proposals on December 20 2019.

. Under the 2020 Tax Reform Act the interest rate applied by tax offices on delinquency tax and on refunds paid to taxpayers will be reduced from the current 16 per annum to 11 per annum. - For financial years commencing as of January 1 2021 the standard rate of. The combined nominal rate of corporation tax and local corporation tax national taxes is 2559 and the effective corporation tax rate national and local combined is.

Japan Highlights 2020 Page 2 of 10 Rate The national standard corporation tax rate of 232 applies to ordinary corporations with share capital exceeding JPY 100 million. Note that the rates for local taxes may vary depending on the size of the business and the place where a company is located. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

Income from 3300001 to 6950000. 17 Individual income taxation tax administration and other reforms investment in 5G infrastructure. - For financial years commencing as of January 1 2020 the 28 percent rate of corporate income tax will become the new standard rate for all taxable profits.

The KPMG Japan Tax Newsletter issued on 18 December 2019 focuses on the Japanese Group Relief System. 2020 Japan tax reform outline Contents Corporate taxation. Medium and small sized company.

List of Countries by Corporate Tax Rate - provides a table with the latest tax rate figures for several countries including actual values forecasts statistics and historical data. Issue 155 January 2020. Size-based business tax consists of two components.

And b approximately 35 with a certain favourable rate for up to the first eight. Comparing Europes Tax Systems. A summary of the major items contained in the 2020 Tax Proposals is set out below.

A approximately 31 for large companies ie companies with a stated capital of more than 100 million yen. Income from 6950001 to 9000000. A rate of 31 percent still applies on profits above EUR 500000 for companies with a turnover of at least EUR 250m.

Chapter 3 - Table 32 Total tax revenue in US dollars at market exchange rate Chapter 3 - Tables 37 to 314 - Taxes as of GDP and as of Total tax revenue Chapter 3 - Table 315 - Tax revenues of subsectors of general government as of total tax revenue. It depends on companys scale location amount of taxable income rates of tax and the other. Corporate Tax Rates around the World 2020.

The special local corporate tax rate is 4142 and is imposed on taxable income multiplied by the standard regular business tax rate. All OECD countries levy a tax on corporate profits but the rates and bases vary widely from country to country. 23 The amendments generally apply to taxable years beginning on or after 1 April 2020 unless.

Japan Income Tax Tables in 2020. Reduction in Special Rate of Interest TaxInterest on Refunded Tax 20 2. Data is also available for.

2020 Japan Tax Reform Proposals. Estimated effective tax rate including Local taxes In addition to National tax above local taxes are levied and the estimated effective tax rate for corporations in Japan is about 30 or less in average now in 2021. Companies also must pay local inhabitants tax which varies with the location and size of the firm.

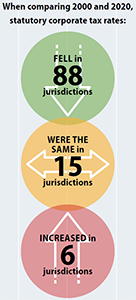

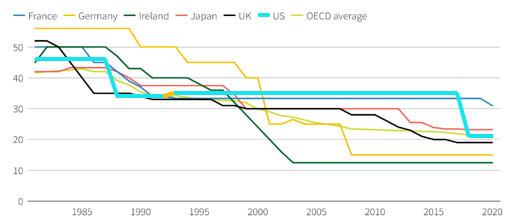

1 Since then countries have recognized the impact that high corporate tax rates have on business investment decisions so that in 2021 the average is now 2354 percent and 2544 when weighted by GDP for 180 separate tax jurisdictions. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019. Income from 9000001 to 18000000.

Enterprise tax and special local corporate tax are taxed based on corporate tax amount of a company however corporations with paid-in capital of more than 100 million Japanese yen are also subject to size-based tax. The regular business tax rates vary between 03 and 14 depending on the tax base taxable income and the location of the taxpayer. On 27 March 2020 Japans 2020 tax reform bill the Bill was enacted following passage of the Bill by the Japanese Diet.

It is expected that most of the items contained in the 2020 Tax Proposals will be passed into law in March 2020. In 1980 corporate tax rates around the world averaged 4011 percent and 4652 percent when weighted by GDP. Income from 1950001 to 3300000.

13 February 2020 Japan tax newsletter Ernst Young Tax Co. On 12 December 2019 the ruling parties in Japan published their 2020 Tax Reform Proposals 2020 Tax Proposals. The corporate income tax is a tax on the profits of corporations.

Amendments to Statute of Limitations for Reassessments or. KPMGs corporate tax rates table provides a view of corporate tax rates around the world. Indirect tax rates individual income tax rates employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by country jurisdiction or region.

On December 12 2019 the ruling parties in Japan published their 2020 Tax Reform Proposals the Proposals. Corporate Taxation in Japan. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

If the tax return is filed late a late filing penalty is imposed at 15 to 20 of the tax balance due. This page displays a table with actual values consensus figures forecasts statistics and historical data charts for - List of Countries by Corporate Tax Rate. Income from 0 to 1950000.

1 The Bill generally follows the tax reform outline announced by Japans coalition leading parties in December 2019. Business Tax System for Companies Conducting the Supply of. 2 International taxation.

Corporate Tax Statistics Third Edition Oecd

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

Inequality And Taxes Inequality Org

Countrywise Withholding Tax Rates Chart As Per Dtaa

Japan S Carbon Tax Policy Limitations And Policy Suggestions Sciencedirect

How Do Taxes Affect Income Inequality Tax Policy Center

Corporation Tax Europe 2021 Statista

Corporation Tax Complete Guide

Global Minimum Corporate Tax Rate Wikipedia

Japan National Tobacco Excise Tax Revenue 2020 Statista

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

Inequality And Taxes Inequality Org

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Corporate Tax Reform In The Wake Of The Pandemic Itep

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday

How Do Taxes Affect Income Inequality Tax Policy Center

Corporate Tax Reform In The Wake Of The Pandemic Itep

G20 Signs Off On 15 Global Minimum Corporate Tax Here S How It Will Work

Japan S Carbon Tax Policy Limitations And Policy Suggestions Sciencedirect